11+ 2nd charge bridging loan

Broker borrower enquiries. Regulated bridge loans are those regulated by the Financial Conduct Authority and are used on properties that you are living or going to live in.

Benefits Of A Second Charge Bridging Loan Mt Finance

When you purchase a property the lender puts a charge over the property and.

. Get expert assistance today were on hand to answer any questions about 2nd charge bridging loans. With the first charge you may be. TABs second charge commercial bridging loans have a loan to value LTV rate of up to 70 of the value of your project including the cost of borrowing and the interest rate charged is from.

A second or third charge bridging loan is additional funding taken out against the same property. A first charge bridging loan is the primary loan that takes priority over all other charges. If the bridging loan is the only loan secured against the property then your bridging.

We deliver essential funding to complete property transactions. The second charge bridging loan application process usually completes in 5 14 days where consent from the first charge lender is forthcoming. You will need to seek permission from your first charge lender if you plan to.

We can supply an AIP within an hour to get things started. In recent years second charge bridging lenders have shown an appetite for second charge Bridging Loans. Second charge bridging loans allow you to raise capital against a property which already has finance secured against it.

Additionally the lender may feel as if there is too much. A 2nd charge loan is highly flexible as it is a quick way of capital raising independently of the principal mortgage. When it comes to loan to value LTV and secondthird charge loans the ratio can drop significantly if the loan is perceived to be very high risk.

If you think you need property finance get in touch with our expert team to secure your second charge bridging loan. The main difference between the two is that with a first charge bridging loan you need to have no mortgage or loan already taken out on the property so if you have any mortgage or loan. Bespoke second charge bridging finance.

A second charge bridging loan could be an ideal solution for those who have a mortgage secured against their property but require additional funding for a short period of time. They are secured by first charges against the. Where first charge lenders are unwilling to.

Yes this very much can and does happen. To find out the exact costs of a Second Charge Bridging Loan get a. Equity is the portion of your home that you own.

As the second charge bridging loan is secured against the equity in your property the amount you can borrow relies on the available equity. Second charge bridging loans - additional finance for urgent business or property transactions. The second charge can only go forward if permission is granted from the first charge provider.

Second Charge Bridging Loans Abc Finance Ltd

Second Charge Bridging Loans From 100 000

What Are First And Second Charge Bridging Loans Crystal Bridging Loans

What Is A Bridging Loan And How Does It Work Mortgageable

Second Charge Bridging Loans Explained Drake Mortgages

Somo Somo Offers 68 Ltv On Second Charge Bridging Loans

![]()

Get A Second Charge Bridging Loan Mercantile Trust Limited

Second Charge Bridging Loans Up To 75 Ltv Mfs

Second Charge Bridging Loan Sort Finance Get Expert Advice

Second Charge Bridging Loans Up To 75 Ltv Mfs

Second Charge Bridging Loans Up To 75 Ltv Mfs

Second Charge Bridging Loans Tab Hq

Second Charge Bridging Loan Sort Finance Get Expert Advice

Second Charge Bridging Loans Conrad Capital

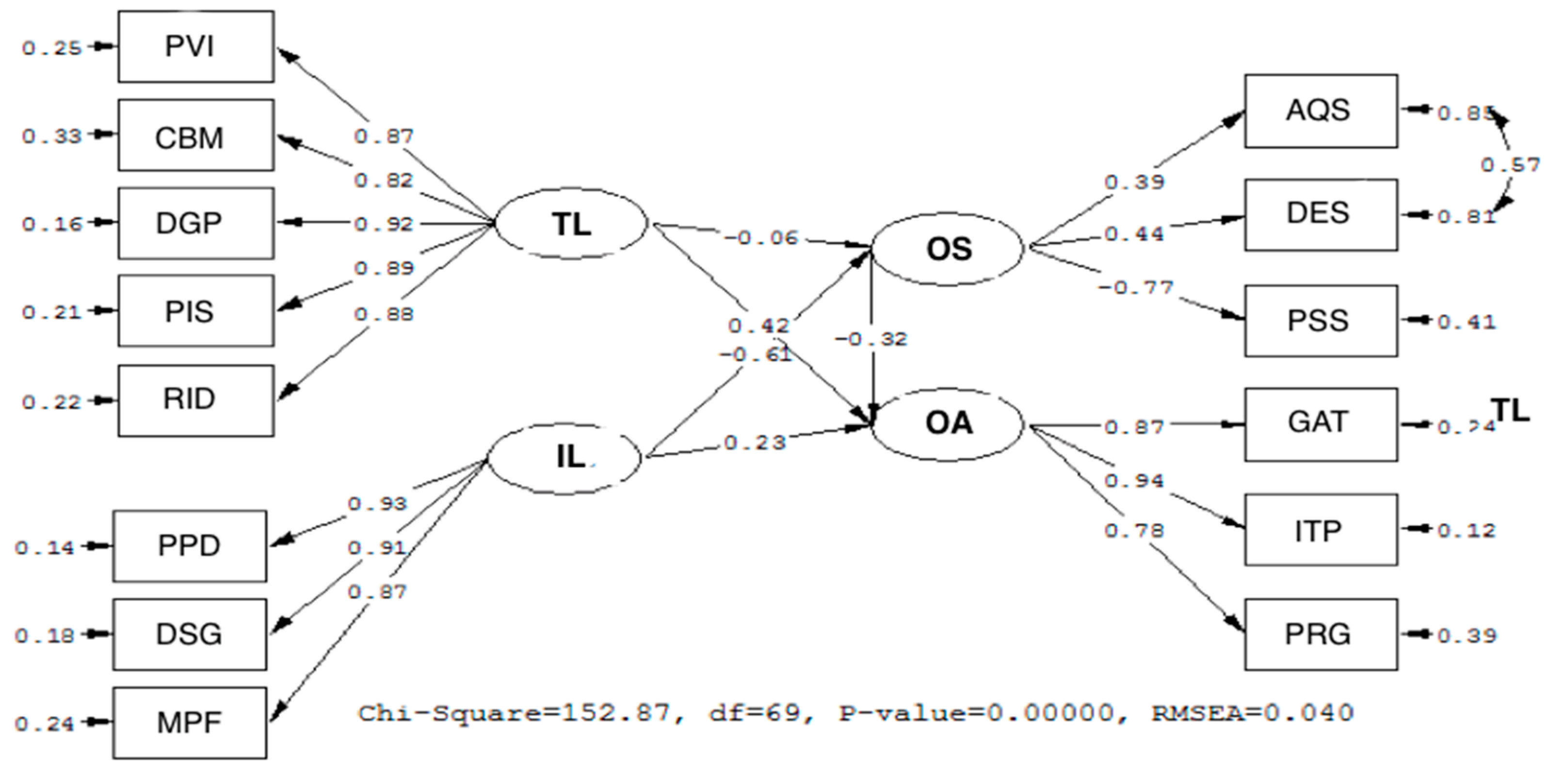

Sustainability Free Full Text Effects Of Transformational And Instructional Leadership On Organizational Silence And Attractiveness And Their Importance For The Sustainability Of Educational Institutions Html

Second Charge Loans Second Legal Charges Mt Finance

Clinch Flexible Property Bridging Finance Approved In Under 6 Hours