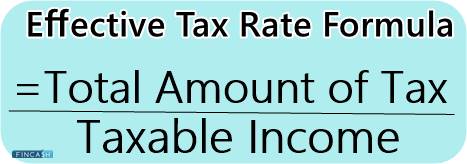

Effective tax rate formula

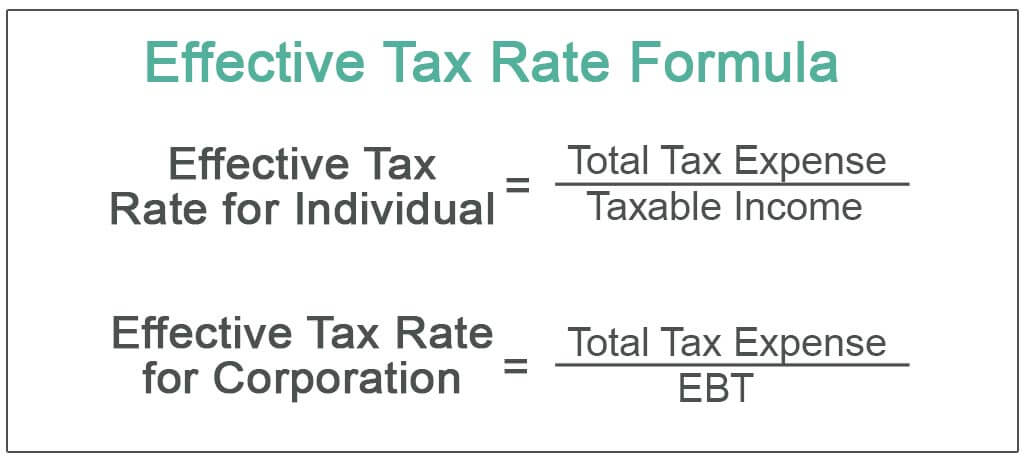

It averages the amount of taxes you paid on all of your income. The effective tax rate for an individual is calculated as.

Definition Of Effective Tax Rate Fincash

Because of the refundable credits the resulting net tax could be negative if the amount of these credits is greater than the.

. The average tax rate helps the government figure out how much tax was paid overall. 50000 x 10 5000 8000 x 15 1200 Alexs total tax liability is 32500 computed as follows. ETR Taxes paid Earned Income What Is The Cpp.

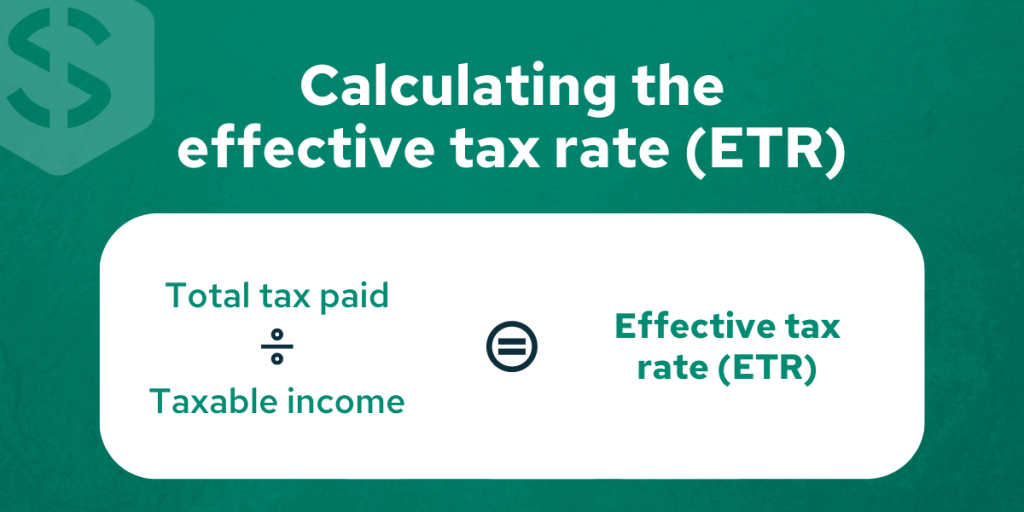

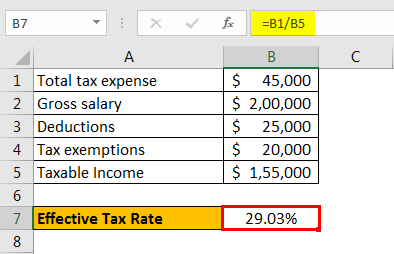

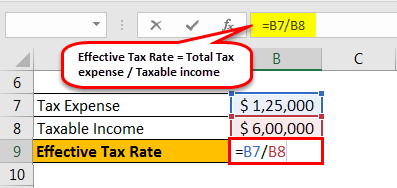

To calculate your individual propertys effective tax rate all you have to do is divide your annual tax bill by what you estimate to be the market value of your property. The effective tax rate for a Corporation is calculated as. The easiest way to calculate the effective tax rate is to divide the total income that an individual pays in taxes by their total taxable income.

Average tax rate or effective tax rate is the share of income that he or she pays in taxes. Based on our example above Sarah. Calculate the effective tax rate.

Your total earnings and total tax bill. The effective tax rate for individuals is found by. Effective Tax Rate Total Tax Liability Total Taxable Income As you can see from this formula what you need to do is to take the.

To calculate your effective tax rate divide your taxes paid by taxable. Total Expense Taxable Income. Heres the formula.

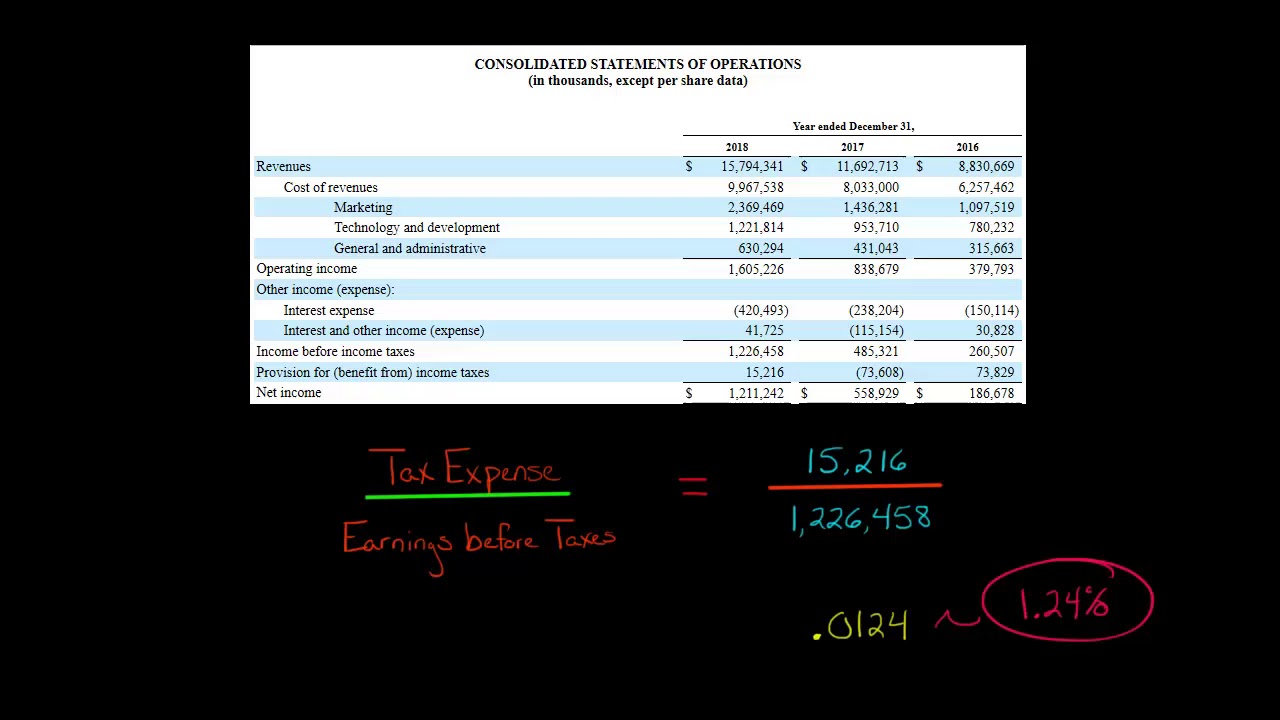

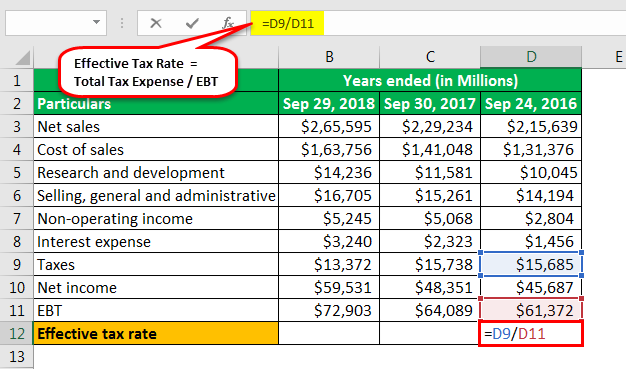

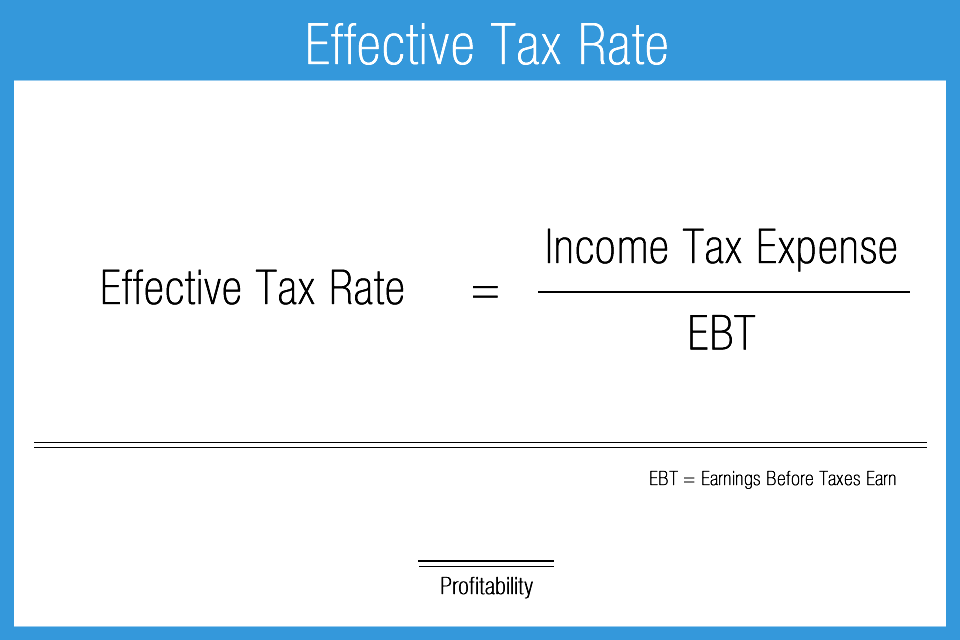

To calculate your effective tax rate divide your taxes paid by taxable income and you get the effective tax rate. Here is the effective tax rate formula. Effective Tax Rate Income Tax Expense Earnings Before Taxes EBT.

Formula to calculate effective tax rate. An individuals effective tax rate represents the average of all tax brackets that their. 3 To calculate this rate take the sum of all your lost income and divide that.

Suppose the income tax expense of a firm is 20000 and its earnings before tax is 300000. 50000 x 10 5000 149999 x 15 22500 20001 x 25 5000 Heres how. Effective tax rate is sometimes referred to as the long-run tax rate and has many applications including the calculation of Net Operating Profit After Tax NOPAT and Return on.

Effective Tax Rate ET Taxes Paid Taxable Income 12358 75000 16477. For corporations the effective tax rate can be found by dividing the tax expense by the earnings before tax of the company. So if you own.

Formulas for effective tax rate. Your effective tax rate is different. To calculate your effective tax rate you need to know two numbers.

The effective tax rate is the tax divided by the income.

Federal Income Tax Calculating Average And Marginal Tax Rates Youtube

How To Calculate The Effective Tax Rate Youtube

Effective Tax Rate Formula And Calculation Example

Effective Tax Rate 101 Calculations And State Rankings Savology

Effective Tax Rate Formula Calculator Excel Template

Effective Tax Rate Definition Formula How To Calculate

Income Tax Formula Excel University

Effective Tax Rate Definition Formula How To Calculate

Effective Tax Rate Formula And Calculation Example

Effective Tax Rate Accounting Play

Effective Tax Rate Formula Calculator Excel Template

Effective Tax Rate Formula Calculator Excel Template

Effective Tax Rate Definition Formula How To Calculate

Effective Tax Rate Definition Formula How To Calculate

Effective Tax Rate Definition

Excel Formula Income Tax Bracket Calculation Exceljet

/dotdash_Final_Tax_Equivalent_Yield_Nov_2020-01-c528a1d54d4f48f19113104ac3291de1.jpg)

Tax Equivalent Yield Definition